The Simplest Way to Budget for Your Life

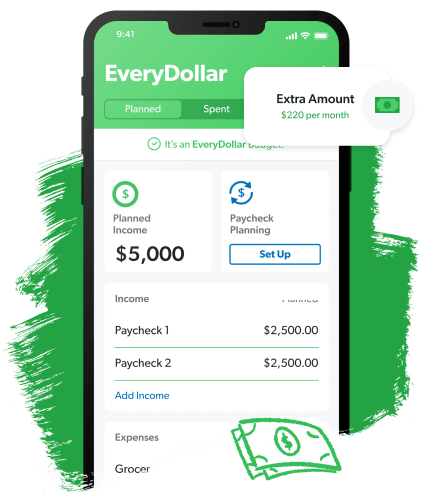

We know you’ve got a lot to juggle—weekly grocery runs, date nights, that surprise flat tire 50 miles into your road trip . . . (Those are the worst, right?) EveryDollar helps you prepare for it all.

The Simplest Way to Budget for Your Life

We know you’ve got a lot to juggle—weekly grocery runs, date nights, that surprise flat tire 50 miles into your road trip . . . (Those are the worst, right?) EveryDollar helps you prepare for it all.

The Simplest Way to Budget for Your Life

We know you’ve got a lot to juggle—weekly grocery runs, date nights, that surprise flat tire 50 miles into your road trip . . . (Those are the worst, right?) EveryDollar helps you prepare for it all.

Listen—you don’t have to cross your fingers every time you swipe your card. When you have a budget (aka a plan for your money), you can spend and save with confidence. Say goodbye to that overwhelmed feeling—because you’re about to start taking control of your money.

In the first month of budgeting with EveryDollar, you can expect to:

Find an extra $395 hiding in plain sight

Cut your monthly expenses by 9%

Sleep 17 times better (okay, we can’t exactly prove this one—but the other two are true)

How to Get Started:

Set up your account.

Create your budget.

Say goodbye to money stress.

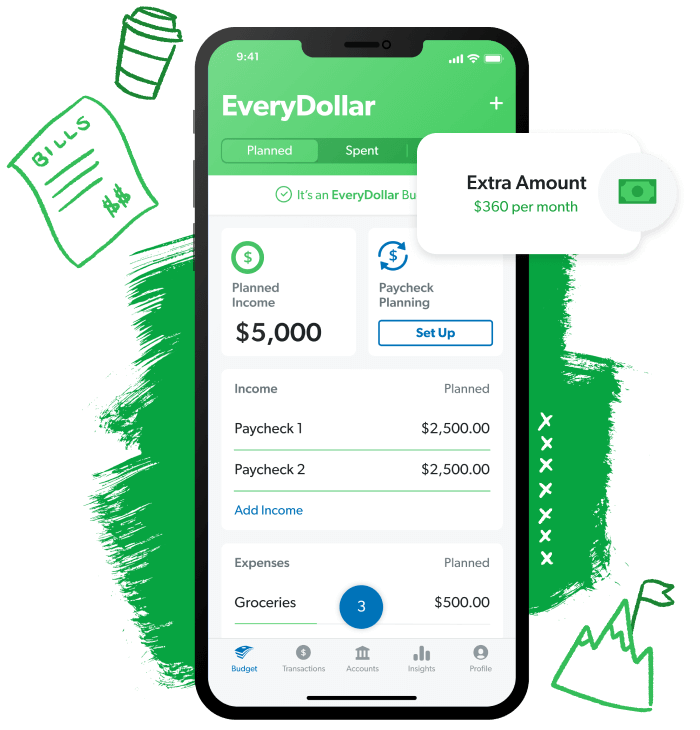

Listen—you don’t have to cross your fingers every time you swipe your card. When you have a budget (aka a plan for your money), you can spend and save with confidence. Say goodbye to that overwhelmed feeling—because you’re about to start taking control of your money.

In the first month of budgeting with EveryDollar, you can expect to:

Find an extra $395

hiding in plain sight

Cut your monthly

expenses by 9%

Sleep 17 times better

(okay, we can’t exactly

prove this one—but

the other two are true)

How to Get Started:

Set up your account.

Create your budget.

Say goodbye to money stress.

Listen—you don’t have to cross your fingers every time you swipe your card. When you have a budget (aka a plan for your money), you can spend and save with confidence. Say goodbye to that overwhelmed feeling—because you’re about to start taking control of your money.

In the first month of budgeting with EveryDollar, you can expect to:

Find an extra $395

hiding in plain sight

Cut your monthly

expenses by 9%

Sleep 17 times better

(okay, we can’t exactly

prove this one—but

the other two are true)

How to Get Started:

Set up your account.

Create your budget.

Say goodbye to money stress.

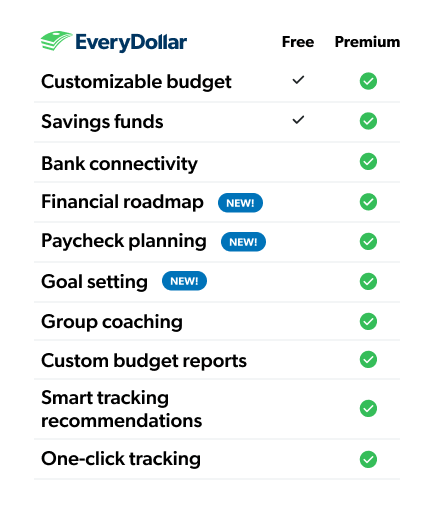

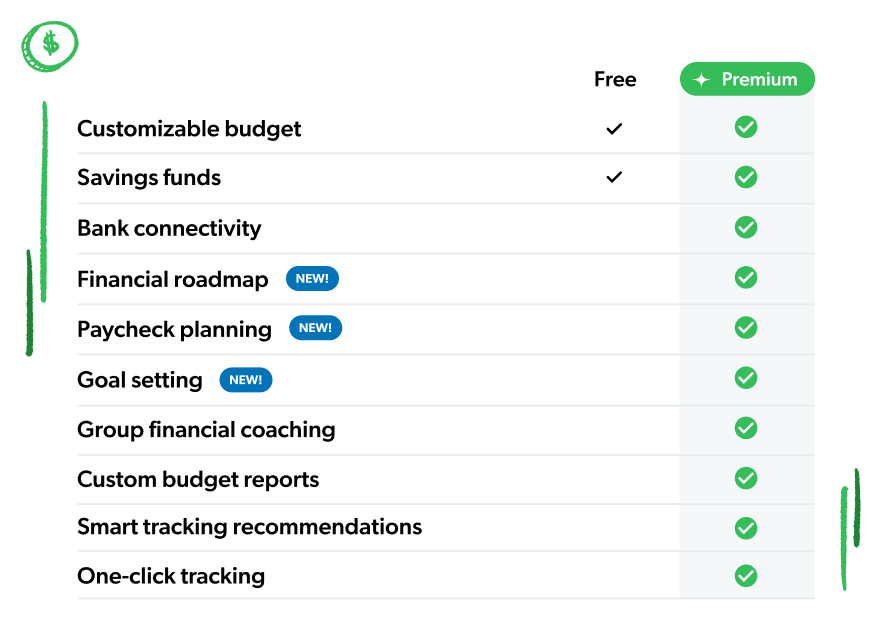

One all-access subscription.

Two ways to pay, after your free trial.

Two ways to pay, after your free trial.

Pay $0.00 today with your 14-day free trial. Cancel anytime. No hassle.

One all-access subscription. Two ways to pay, after your free trial.

Pay $0.00 today with your 14-day free trial. Cancel anytime. No hassle.